How to Calculate Risk Adjusted Npv

NPV 100000 INR. NE Net effect of debt The net effect of debt includes tax benefits that are created when the interest on a.

Tax Shield A Tax Shield is an allowable.

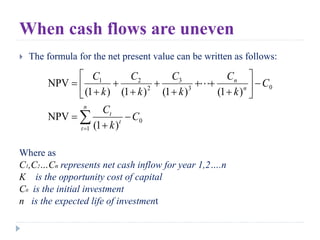

. Plugging in the numbers from the table we have the following formula. For example a first-year cash flow estimate. The overall required return is called the money or nominal rate of return.

There is a choice between two approaches. WACC w e k e w p k p w d k d 1 - t Where we wp and wd are the target weights of common stock preferred stock and debt respectively in the companys capital structure. The real and money nominal returns are linked by the formula.

The asset over its life at a risk-adjusted discount rate. A good place to start is the risk-free rate the rate you can earn on US. As per formula used in BI reports for deriving Risk Adjusted.

Adjusted Present Value formula and calculations apv pv cf pv ts apv apv Calculator Input Values Project Cost pc Cash Flow cf Interest Expense e Risk Rate r Asset Beta a Market Return mr Cost of Debt cod Tax Rate t 17 Votes Why do companies use Adjusted Present Value. Derived Risk 35. The Adjusted Present Value for valuation The APV method to calculate the levered value VL of a firm or project consists of three steps.

Im trying to determine the effective discount rate y implied in this model. Step 1 Calculate the value of the unlevered firm or project VU ie. Real return for the use of their funds ie.

N is the period into infinity. 80 and pcs 50. For example an early-stage ie riskier product with higher revenue potential may be as attractive.

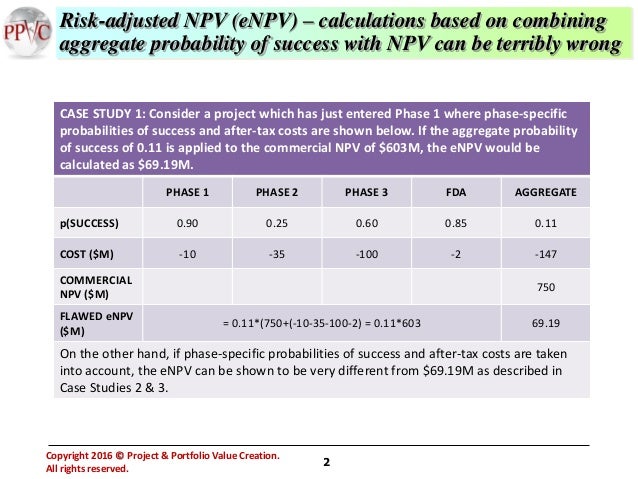

Costs and benefits are estimated at constant todays cost and the discount rate calculated net of inflation or. Risk-adjusted NPV Risk adjusted NPV The risk adjusted NPV Country risk assessment Risk-adjusted NPV for G. The return they would want if there were no inflation in the economy additional return to compensate for inflation.

Select a cell in Microsoft Excel. This video will help the students not just to understand the concept of RADR and its relevance in risk analysis in capital budgeting but also help them calcu. The effects of inflation on costs and benefits are included in the model and the discount rate determined using nominal rates.

Similarly ke kp and kd represent the cost of equity cost of preferred stock and cost of debt respectively. This Risk-Adjusted Net Present Value RA NPV forecast calculator is a useful metric to compare several programs in terms of their risk and value. Where V is the present value.

Value 1 and Value 2 are the cash flows of the project. Real discount rate 1 nominal discount rate 1inflation rate 1 nominal discount rate inflation rate 1 92 15 1 4 Net present value 4452 million 25 million 1952 million. It is a more flexible valuation tool to show benefits such as tax shields.

APV Adjusted Present Value is a modified form of Net Present Value NPV that takes into account the present value of leverage effects separately. They are first adjusted with the risk factor and then used to calculate. The risk premium is calculated as the difference between the market rate of return and the risk-free rate of return multiplied by the beta.

X is the discount rate. The relationship between nominal discount rate real discount rate and inflation can be rearranged as follows. Risk-Adjusted NPV forecast model with Basic and Advanced inputs one indication one geography.

APV splits financing and non-financing cash flows and discounts them separately. The same data as Case Study 1 except that Phase 2 and Phase 3 probabilities of success are switched without changing the aggregate probability of success and using Decision Tree analysis the eNPV. In the Main menu go to Tools RA NPV forecast.

Unlevered cost of capital rU Risk-free rate beta Expected market return Risk-free rate. Risk-adjusted NPV also known as rNPV does not use the estimates of future cash flows as it is in the calculation. BioHeights has launched a Risk-Adjusted NPV calculator for an investigational product.

It should be noted that some methods for calculating. Risk 1 80 1 50 2. NPV Initial Investment Annual Return Return on Equity.

This will prompt an auto formula like the following. The formula is as follows. Therefore NPV is.

Risk-adjusted NPV eNPV calculations based on Decision Tree analysis with phased risk and cost decomposition II CASE STUDY 3. And P is the probability of success of the project. Wolfe Corporation CAPM risk-adjusted net present value simulation Investment in a security Risk-adjusted net present value Scenario analysis and risk-adjusted NPV Kaimalino Properties KP IRR NPV capital limits.

Adjusted Present Value Unlevered Firm Value NE where. Determining the risk-adjusted net present value rNPV like NPV also involves forecasting the revenues cash inflows costs cash outflows and their respective timing but additionally requires the relevant success rate s for each stage of development. I have built a risk-adjusted NPV model to calculate the value of a medtech company.

RA NPV Forecast Calculator. The Risk-Adjusted Net Present Value RA NPV is a useful metric to compare several programs in terms of their risk and value. NPV rate value 1 value 2 Rate is the discount rate for the project.

NPV Net Present Value Derived Risk 100. It is calculated using the following formula. Its value with all-equity financing.

1 i 1 r 1 h where. Value of asset ECF 1 1r ECF 2 1r2 ECF 3 1r3 ECF n 1rn where the asset has a n-year life ECF t is the expected cash flow in period t and r is a discount rate that reflects the risk of the cash flows. All rights reserved.

For example an early-stage ie riskier product with higher revenue potential may be as attractive as a late-stage. 1- Probability Technical Success 1 Probability Commercial Success 2. C is the cash flow in year n.

Calculating Risk Adjusted Npv Enpv The Right Way

Npv Adalah Rumus Dan Contoh Perhitungan

Net Present Value Npv Vs Internal Rate Of Return Irr Acca Exam Investing Exam Net

Comments

Post a Comment